|

|

|

|

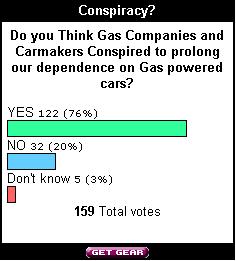

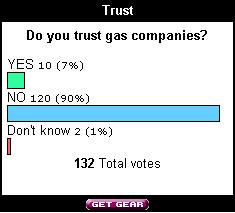

The price of gas keeps going up and up. Now we see that food prices are also going up because it costs money to produce and haul food to it''s destination. Food staples like wheat, rice and corn are getting expensive and fuel costs are partly to blame for this. It's a vicious circle. Do the gas companies really think this will not come back to bite them. As public trust of oil companies continues to diminish, they may find they could be facing a strong consumer backlash. It''s true they hold the oil and gas but we hold the dollar and remember, it ain''t called the almighty dollar for nothing. Oil companies sell gas and carmakers sell cars that use gas so it's a mutually beneficial situation for both of them. The solution is to stop buying new cars for a year until carmakers start building 100% electric or hydrogen powered cars, not hybrids. This would send a message to both the carmakers and oil companies that they understand. Sorry carmakers but you brought this on yourself by not speeding up the conversion. No pain no gain.

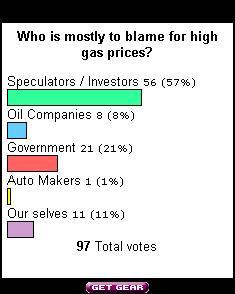

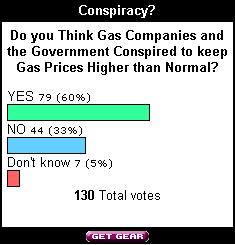

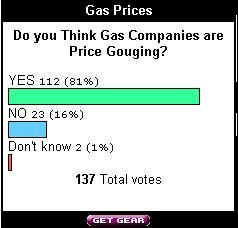

Here is a Letter posted on Market Watch: I find it interesting that billionaire financier George Soros calls this OIL phenomena a Bubble when everyone else sees a sharp spike in oil prices. He says he believes there are lots of bubbles building in financial markets, and in OIL. To quote him he says "He believes better regulation is necessary to keep commodity prices at more reasonable levels." That's what I have also been saying. The government needs to step in and do something about commodities trading. First of all, OIL and Gas should not be traded like poker chips. The consequences of a mistake are far too grave. Look whats happening in Europe now with strikes and protests etc. Imagine if the same thing happened here. To help make my point imagine if we traded wheat commodities and wheat jumped 100 percent so traders all jumped in and bought more driving the cost up even higher... soon the whole world would starve because wheat prices would skyrocket. There are probably controls on wheat trading so this can't really happen but what about oil. Can Investors drive the price up indefinitly? What controls are in place to prevent a huge spike in prices on the NYMEX. Oil is a key commodity and it's basic for the proper operation of commerce in America. For investers to gamble with this commodity in Futures speculation is very irrational and irresponsible. I firmly believe there needs to be safety controls in place to prevent greed driven spikes in prices on the commodities exchange the same as there were safety controls implimented after the great crash of the Thirty's to prevent a bottoming out of stocks. It's a big game to them... but if the rules of the game are flawed then accidents happen. A huge spike could take prices through the roof and this would not be good for for anyone except PERHAPS for the speculator involved. The Canadian Government is investigating this as we speak and rightly so. If other governments follow suit then futures traders may be forced to follow new rules of trading. Visit our website and take part in our gas poll on http://www.nbtv.ca Here is a letter posted on Forbes.com I am not sure investing in oil is such a good idea. Multi-millionair Richard Rainwater is selling off almost all his oil investments. Maybe he knows something we don't. There are other factors that would also seem to indicate that the OIL bubble is about to burst. Saudi Arabia is increasing oil output along with the United Kingdom and there is some talk of imposing regulations on oil commodities trading to stem big hikes is prices. Even the UN is worried about global sustainability with oil binging so high. Others keep bringing up India and China as an excuse for high prices but I don't buy it. They subsidize oil and they won't be able to keep doing that much longer at these prices. If I had any investments in oil right now I would sell them as fast as I could. But that's just me. On our website we conducted a poll, asking the question "who do you think is to blame for high gas prices" over half blame speculation. http://www.nbtv.ca Update on CBC.ca Is it possible that the OIL bubble has burst?? The good news is oil prices dropped $5 today . I said China would drop the subsidies on oil and that's what happened today. Saudi Arabia is saying they will try to guarantee oil supplies and they will work with OPEC to maintain that supply. Many governing bodies are thinking about putting new controls on Futures trading. This is good news unless of course you own oil futures. New regulations are necessary though, because a huge greed driven spike in oil can cause fear among all other investment sectors that are adversely affected by high oil prices. That fear would trigger a market reversal of grand proportions that would far out-weight any gains made by oil. Check our gas poll results at http://www.nbtv.ca Posted on USAToday Although oil appears to be a good hedge against inflation, the low dollar and a low oil supply, nothing could be farther from the truth. Our oil supply is becoming less of an issue because inflation is causing a surplus of gas. The main thing driving inflation is high oil prices and as inflation goes higher investors buy more oil driving inflation higher again. Some experts predict this will trigger the worldwide recession. This will result in lower gas consumption and it will free up more gas supplies.. I am no expert but even I can see the writing on the wall. Investors are going to loose their shirts on oil. We may be looking at another ENRON. Hedge funds will topple leaving old age pensioners with nothing. The government won''t be able to bail them out this time because the cost would be far to great. The CFTC and ICE will be too slow to react to the cracks forming in commodities trading so the govenment will finally step in. By that time it will probably be too late. www.nbtv.ca Posted on The Taunton Gazette Saudi Arabia says oil is over priced. Others experts are also are saying the same thing. There is no shortage of oil, just bad management of inventory levels. The oil bubble will burst some day soon. That's what happens to big bubbles. Oil futures have been artificially inflated in value by commodities traders for weeks. Traders like Goldman Sachs and Morgan Stanley are making a fortune. I think new regulations are necessary. I find it interesting that billionaire financier George Soros calls this OIL phenomena a Bubble when everyone else sees a sharp spike in oil prices. He says he believes there are lots of bubbles building in financial markets, and in OIL. To quote him he says "He believes better regulation is necessary to keep commodity prices at more reasonable levels." That's what I have also been saying. The government needs to step in and do something about commodities trading. First of all, OIL and Gas should not be traded like poker chips. The consequences of a mistake are far too grave. Look whats happening in Europe now with strikes and protests etc. Imagine if the same thing happened here. To help make my point imagine if we traded wheat commodities and wheat jumped 100 percent so traders all jumped in and bought more driving the cost up even higher... soon the whole world would starve because wheat prices would skyrocket. There are probably controls on wheat trading so this can't really happen but what about oil. Can Investors drive the price up indefinitely? What controls are in place to prevent a huge spike in prices on the NYMEX. Oil is a key commodity and it's basic for the proper operation of commerce in America. For investers to gamble with this commodity in Futures speculation is very irrational and irresponsible. I firmly believe there needs to be safety controls in place to prevent greed driven spikes in prices on the commodities exchange the same as there were safety controls implimented after the great crash of the Thirty's to prevent a bottoming out of stocks. It's a big game to them... but if the rules of the game are flawed then accidents happen. I am refering to the ENRON LOOPHOLE, SWAPS LOOPHOLE, and LONDON LOOPHOLE. A huge spike could take prices through the roof and this would not be good for for anyone except perhaps for the speculator involved. The Canadian Government is investigating this as we speak and rightly so. If other governments follow suit then futures traders may be forced to follow new rules of trading. When fear, greed and suspicion surround an activity what does that tell you? The commodities market needs a good overhaul to bring some credibility back into commodities trading. New regulations are necessary because a huge greed driven spike in oil can cause fear among all other investment sectors that are adversely affected by high oil prices. That fear would trigger a market reversal of grand proportions that would far out-weight any gains made by oil. These high prices are not sustainable and jeopardise economic growth globally, The price is inflated far above it's true value which is probably closer to 80 dollars a barrel. Visit our website and take part in our gas poll on. We asked who's to blame for high gas prices and got some very interesting results. Over half of respondence say they blame speculation for the problem. http://www.nbtv.ca Posted on The Wall Street Journal Ever ask yourself why gas is so exspensive? Appearently, few have heard the Vitol news yet. Vitol is a Swiss company that manipulated 11% of oil futures trading on the New York Mercantile Exchange between June 5 and June 11 this year when the price of oil was near it's highest level. They are said to have made over 100 billion dollars in revenue this year. This is why gas prices are so high, not because of Hurrican Gustav or Russia invading Georgia or China's consumption or violence in Nigeria or supply and demand, a low dollar or any other nonsense you may read. It's because big companies manipulate the price of oil on the commodities exchange. I have included the link to the article on the Washington Post site. See the article titled "A Few Speculators Dominate Vast Market for Oil Trading" http://www.washingtonpost.com/wp-dyn/content/article/2008/08/20/AR2008082003898.html?hpid%3Dtopnews&sub=AR Also read the International Herald Tribune Report: One trader held 11 pct of Nymex contracts http://www.iht.com/articles/ap/2008/08/21/business/NA-US-Oil-Markets-Speculation.php And read The New York Times article "Meet the Mystery Oil Speculator" http://dealbook.blogs.nytimes.com/2008/08/21/meet-the-mystery-oil-speculator |